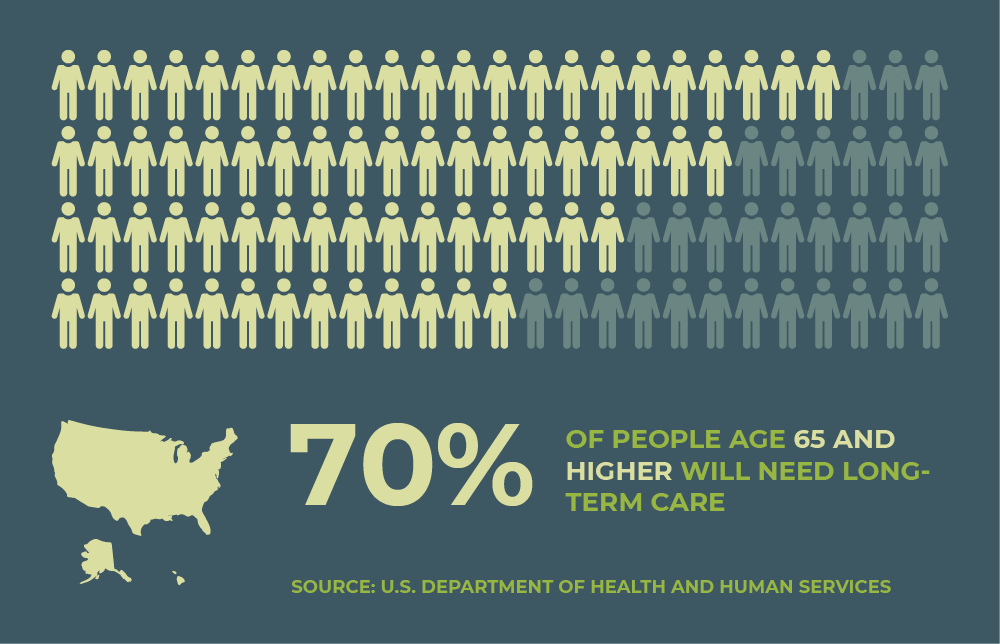

Long-term care expenses are often inevitable and always difficult to discuss. No one wants to envision themselves needing it. Yet, according to research by the U.S. Department of Health and Human Services, 70% of those age 65 and higher will need some form of long-term care. And paying out of pocket is not in the cards for most of us, since the median cost for a private nursing home room is over $97,000 per year, though it’s even more if you live in a major metro area. So, for the majority of Americans approaching retirement with some savings, an investment portfolio, a 401(k) or another plan for funding retirement, un-planned long-term care could spell real financial peril.

Also – don’t you know it – there’s a gap between the sexes. Women populate long-term care facilities more often than men do, and for almost twice as long. A solid 70% of the nursing home population in America is female. Which leads to one practical, and potentially cost-saving decision on the road to clarifying a long-term care plan. If long-term care for a couple looks to be too expensive given your fixed income through retirement, you might consider applying it to just the woman in the relationship.

As with many moments in life from weddings to the birth of a child to funding a college education for that child, research is key. You should consider researching the general costs from long-term care facilities in your area and work up an estimate of what your monthly costs would be. You can then select the best association policy for you.

Traditional long-term care insurance, where you pay a monthly, quarterly or annual premium is the easiest to understand. In exchange, you’ll get a monthly or daily benefit amount should you become eligible for care. However, there are also new hybrid universal life policies that address long-term care with set periods of time for the premiums.

If you have an existing life insurance policy, it could be an asset of yours with ownership rights. Life insurance policies have a certain value that’s often forgotten in the shuffle. For example, some folks with life insurance allow it to lapse at a certain time because it’s no longer needed. However, they might actually be able to convert it into a long-term care benefit.

In addition to all of the above, there are practical considerations when not opting to live in a facility, but rather, living at home with care. You may need assistance with everyday tasks like housework, taking medication, grocery shopping, preparing meals, caring for pets and even managing money. And there’s a myriad of solutions that address these needs. Perhaps it’s actually short-term care, which your association can help you with, too.

Regardless of which path you take on your road to retirement including finding the best long-term care solutions for you and your family, your association is here to provide advice, and the collective wisdom of peers’ experience, along with support from partners like AMBA and its friendly experts to help with your insurance needs. Learn more on the association’s website and www.myambabenefits.info.

Sources:

Authors unattributed, What Is Care?, How Much Care Will You Need?, U.S. Dept. of Health and Human Services, retrieved from: https://longtermcare.acl.gov/the-basics/what-is-long-term-care.html

Carlos Dias, Jr., Six Options to Fund Long-Term Care in Retirement, Kiplinger’s, retrieved from: https://www.kiplinger.com/article/retirement/T036-C032-S014-6-options-to-fund-long-term-care-in-retirement.html